Raymond James & Associates raised its place in Planet Fitness, Inc. (NYSE:PLNT – Get Rating) by 21.5% within the third quarter, in accordance with its most up-to-date submitting with the SEC. The agency owned 46,382 shares of the corporate’s inventory after buying an extra 8,198 shares in the course of the interval. Raymond James & Associates owned roughly 0.05% of Planet Fitness value $2,674,000 on the finish of the latest reporting interval.

→ Is This The End of Capitalism? (From Porter & Company)

Several different hedge funds additionally just lately made modifications to their positions within the firm. First Horizon Advisors Inc. lifted its stake in shares of Planet Fitness by 290.5% within the second quarter. First Horizon Advisors Inc. now owns 781 shares of the corporate’s inventory valued at $53,000 after buying an extra 581 shares in the course of the interval. Ellevest Inc. lifted its stake in shares of Planet Fitness by 1,098.8% within the second quarter. Ellevest Inc. now owns 971 shares of the corporate’s inventory valued at $66,000 after buying an extra 890 shares in the course of the interval. Parallel Advisors LLC lifted its stake in shares of Planet Fitness by 565.3% within the second quarter. Parallel Advisors LLC now owns 1,437 shares of the corporate’s inventory valued at $98,000 after buying an extra 1,221 shares in the course of the interval. Captrust Financial Advisors lifted its stake in shares of Planet Fitness by 23.0% within the first quarter. Captrust Financial Advisors now owns 1,172 shares of the corporate’s inventory valued at $99,000 after buying an extra 219 shares in the course of the interval. Finally, Brown Brothers Harriman & Co. bought a brand new place in Planet Fitness in the course of the 2nd quarter valued at about $108,000. Institutional traders and hedge funds personal 94.56% of the corporate’s inventory.

Analyst Upgrades and Downgrades

Several analysis corporations have weighed in on PLNT. Cowen raised their goal value on shares of Planet Fitness from $80.00 to $90.00 in a report on Wednesday, November sixteenth. Robert W. Baird raised their goal value on shares of Planet Fitness from $95.00 to $100.00 and gave the corporate an “outperform” score in a report on Wednesday, January eleventh. BMO Capital Markets raised their goal value on shares of Planet Fitness from $88.00 to $90.00 and gave the corporate an “outperform” score in a report on Wednesday, November ninth. Guggenheim dropped their goal value on shares of Planet Fitness to $85.00 in a report on Tuesday, November 1st. Finally, Raymond James raised their goal value on shares of Planet Fitness from $84.00 to $92.00 in a report on Wednesday, November sixteenth. Three analysts have rated the inventory with a maintain score, ten have given a purchase score and one has assigned a robust purchase score to the inventory. According to MarketBeat.com, the corporate has a consensus score of “Moderate Buy” and a mean value goal of $93.46.

Planet Fitness Stock Performance

Planet Fitness stock opened at $79.22 on Friday. Planet Fitness, Inc. has a 1 12 months low of $54.15 and a 1 12 months excessive of $97.04. The agency has a 50 day shifting common value of $77.94 and a 200 day shifting common value of $72.06. The firm has a market cap of $7.10 billion, a price-to-earnings ratio of 94.31, a PEG ratio of 1.28 and a beta of 1.23.

Planet Fitness (NYSE:PLNT – Get Rating) final launched its earnings outcomes on Tuesday, November eighth. The firm reported $0.42 earnings per share (EPS) for the quarter, beating analysts’ consensus estimates of $0.39 by $0.03. Planet Fitness had a web margin of 8.52% and a unfavourable return on fairness of 36.77%. The agency had income of $244.39 million in the course of the quarter, in comparison with the consensus estimate of $237.40 million. Sell-side analysts predict that Planet Fitness, Inc. will put up 1.59 EPS for the present 12 months.

About Planet Fitness

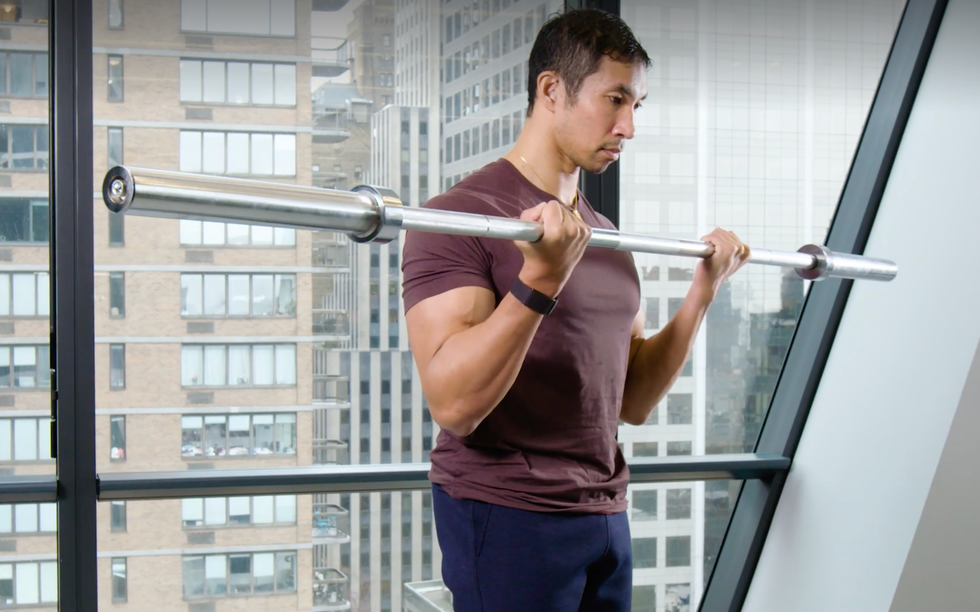

Planet Fitness, Inc engages within the operation and franchising of health facilities. It operates by way of the next segments: Franchise, Corporate-Owned Stores, and Equipment. The Franchise phase contains operations associated to the corporate’s franchising enterprise within the United States, Puerto Rico, Canada, the Dominican Republic, Panama, Mexico, and Australia.

Recommended Stories

Want to see what different hedge funds are holding PLNT? Visit HoldingsChannel.com to get the newest 13F filings and insider trades for Planet Fitness, Inc. (NYSE:PLNT – Get Rating).

This prompt information alert was generated by narrative science expertise and monetary knowledge from MarketBeat in an effort to present readers with the quickest and most correct reporting. This story was reviewed by MarketBeat’s editorial workforce previous to publication. Please ship any questions or feedback about this story to [email protected].

Before you take into account Planet Fitness, you may wish to hear this.

MarketBeat retains observe of Wall Street’s top-rated and finest performing analysis analysts and the shares they suggest to their purchasers every day. MarketBeat has recognized the five stocks that high analysts are quietly whispering to their purchasers to purchase now earlier than the broader market catches on… and Planet Fitness wasn’t on the record.

While Planet Fitness presently has a “Moderate Buy” score amongst analysts, top-rated analysts consider these 5 shares are higher buys.

https://news.google.com/__i/rss/rd/articles/CBMiSmh0dHBzOi8vd3d3Lm1hcmtldGJlYXQuY29tL2luc3RhbnQtYWxlcnRzL255c2UtcGxudC1zZWMtZmlsaW5nLTIwMjMtMDEtMjIv0gEA?oc=5