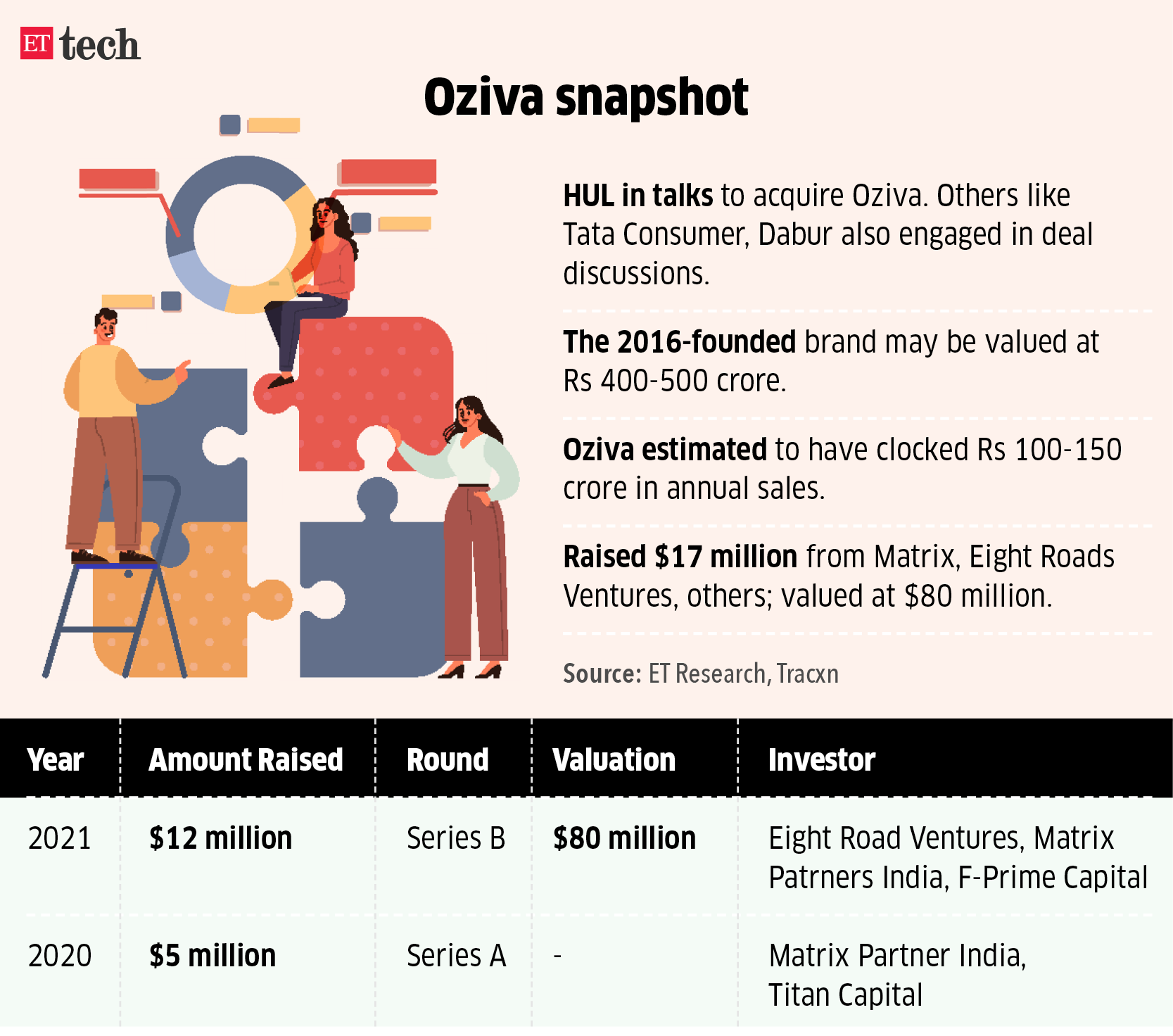

Hindustan Unilever (HUL) has held talks to accumulate plant-based complement model Oziva, a number of folks within the know mentioned, signalling the beginning of what might set off a wave of consolidation within the direct-to-consumer (D2C) model market.

Oziva, which sells vitamin and health merchandise throughout classes equivalent to girls’s well being, pores and skin, hair, males’s well being and common wellness, competes with the likes of Amway, GNC and unbranded dietary supplements from Indian pharma firms.

People aware about the deal mentioned Oziva hoped for a valuation of Rs 400-500 crore that may very well be a stumbling block for a cope with HUL, mentioned folks aware of the deal. Founded in 2016 by Aarti Gill and Mihir Gadani, Oziva had additionally approached different shopper items firms together with Dabur and Tata Consumer, however these discussions have stalled because of a valuation mismatch.

“They have been in superior discussions with HUL, however their gross sales numbers have dropped from the height which can affect the valuation and total transaction,” mentioned an individual aware of the talks.

In an interview with ET final 12 months, the corporate mentioned its annualised income grew fourfold from the earlier 12 months and it was aiming to high Rs 500 crore within the subsequent three years. Sources conscious of the goings-on on the firm mentioned Oziva was clocking round Rs 12 crore in month-to-month gross sales and would have seemingly closed at Rs 100-150 crore in annual gross sales for 12 months ended March 2022.

“They have been in superior discussions with HUL, however their gross sales numbers have dropped from the height which can affect the valuation and total transaction,” mentioned an individual aware of the talks.

The six-year outdated startup is backed by enterprise capital funds like Matrix Partners and Eight Roads Ventures, and has in all picked up $17 million in funding. It was valued at $80 million when it raised financing final 12 months, as per Tracxn, an information platform.

When contacted by ET, HUL and Tata Consumer mentioned they can’t touch upon market hypothesis whereas Oziva mentioned the knowledge is “baseless and inaccurate.”

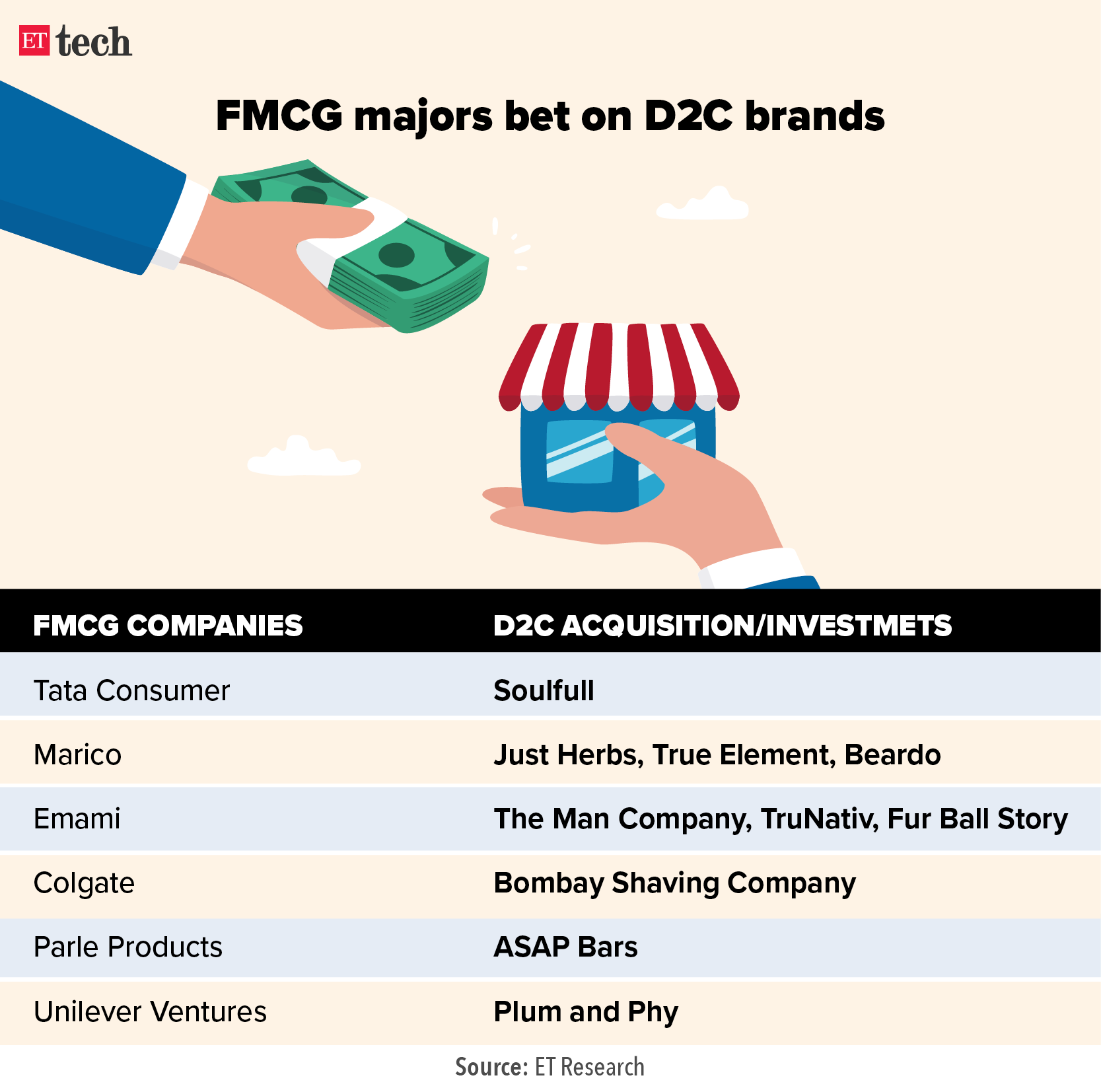

FMCG majors eye D2C manufacturers

An investor within the shopper section mentioned historically FMCG biggies, particularly in international markets, have been acquirers of D2C manufacturers if the segments are a development space for them. In India, although the likes of HUL haven’t made large strides by shopping for these specialised manufacturers, largely as a result of the dimensions of most online-focussed manufacturers continues to be small.

In reality, a big set of those so-called D2C manufacturers have now diversified to promote via brick and mortar channels to rack up gross sales.

Marico, ITC, and even HUL, have been investing in D2C manufacturers that gained big momentum throughout the pandemic when on-line purchasing noticed a serious uptick. Marico picked up a 54% stake in HW Wellness Solutions, which owns wholesome breakfast and snacks model True Elements in May. Last 12 months, Tata Consumer acquired a 100% stake in Kottaram Agro Foods—the maker of Soulfull model of breakfast cereals and millet-based snacks.

While the plant-based meals class is a nascent section in India and estimated to be about Rs 2,000 crore robust the place greater than 250 startups have entered over the previous few years, in line with Plant Based Foods Industry Association. Analysts monitoring the sector anticipate consolidation within the total D2C area, together with well being and wellness sub-segment.

“There will likely be a bigger massacre within the shopper D2C area as giant firms will concentrate on getting into area of interest segments primarily via acquisitions. A Rs100 crore model might fetch round 7-8 instances gross sales multiples however given the funding winter, the valuation will purely rely available on the market potential and have to be current within the area,” mentioned Abneesh Roy, govt director at Nuvama Institutional Equities, including that HUL’s previous acquisitions like Indulekha, V Wash and Aaditya Milk have fared nicely and Oziva will assist them strengthen clear pure product section.

“HUL might even have a look at buying the model regularly as a substitute of an entire buyout after they consider and combine the channel nuances and cultural match,” Roy added.

Recently, Aditya Birla Fashion acquired attire model Bewakoof in a misery sale as a part of its wider push into making a home of manufacturers.

Nutraceuticals section

According to market analysis agency Euromonitor, the Indian nutraceuticals market is presently value Rs 47,000 crore with half the section dominated by fortified and purposeful meals merchandise adopted by dietary dietary supplements which account for 1 / 4 of the section.

Mainstream fast-moving shopper items firms have entered the market, largely within the purposeful meals class. HUL had mentioned it might double down on the dietary and excessive protein segments via Horlicks, whereas Marico launched protein shakes beneath Saffola Fittify a couple of years in the past. Danone’s Protinex, which was initially into the area of interest excessive protein dietary section, entered bars and able to drink section a couple of years in the past.

Over the previous three years, globally Unilever has closed a spate of acquisitions within the well being and wellness area together with Liquid I.V, Nutrafol, a hair wellness model, Onnit, a holistic wellness and life-style firm, complement corporations SmartyPants Vitamins and OLLY Nutrition.

https://news.google.com/__i/rss/rd/articles/CBMijwFodHRwczovL2JyYW5kZXF1aXR5LmVjb25vbWljdGltZXMuaW5kaWF0aW1lcy5jb20vbmV3cy9idXNpbmVzcy1vZi1icmFuZHMvaHVsLW90aGVyLWZtY2ctbWFqb3JzLWluLXNhbGUtdGFsa3Mtd2l0aC1udXRyaXRpb24tZmlybS1veml2YS85NjA2NTc1M9IBkwFodHRwczovL2JyYW5kZXF1aXR5LmVjb25vbWljdGltZXMuaW5kaWF0aW1lcy5jb20vYW1wL25ld3MvYnVzaW5lc3Mtb2YtYnJhbmRzL2h1bC1vdGhlci1mbWNnLW1ham9ycy1pbi1zYWxlLXRhbGtzLXdpdGgtbnV0cml0aW9uLWZpcm0tb3ppdmEvOTYwNjU3NTM?oc=5