The exterior fund supervisor backed by Berkshire Hathaway’s Charlie Munger, Li Lu, makes no bones about it when he says ‘The largest funding danger isn’t the volatility of costs, however whether or not you’ll endure a everlasting lack of capital.’ When we take into consideration how dangerous an organization is, we all the time like to have a look at its use of debt, since debt overload can result in destroy. Importantly, Happy Valley Nutrition Limited (ASX:HVM) does carry debt. But is that this debt a priority to shareholders?

When Is Debt Dangerous?

Debt is a instrument to assist companies develop, but when a enterprise is incapable of paying off its lenders, then it exists at their mercy. In the worst case situation, an organization can go bankrupt if it can’t pay its collectors. While that’s not too frequent, we regularly do see indebted firms completely diluting shareholders as a result of lenders pressure them to lift capital at a distressed worth. Having mentioned that, the most typical state of affairs is the place an organization manages its debt fairly properly – and to its personal benefit. The first step when contemplating an organization’s debt ranges is to contemplate its money and debt collectively.

View our latest analysis for Happy Valley Nutrition

What Is Happy Valley Nutrition’s Debt?

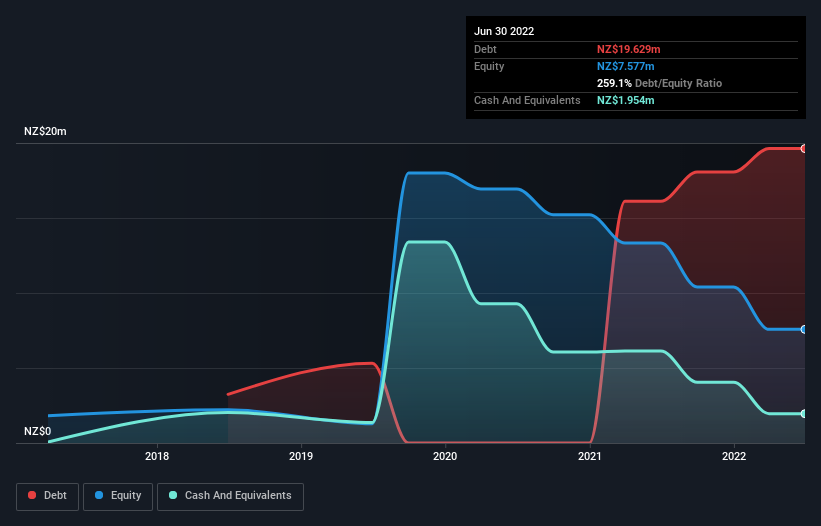

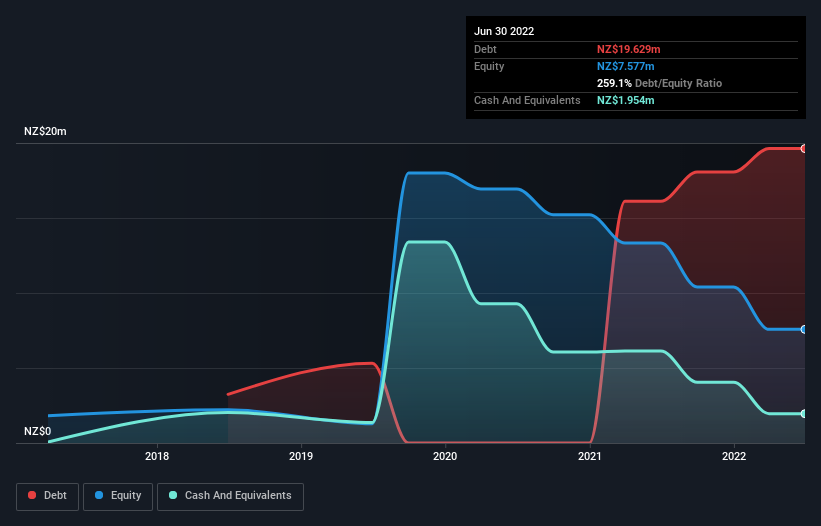

As you’ll be able to see under, on the finish of June 2022, Happy Valley Nutrition had NZ$19.6m of debt, up from NZ$16.1m a yr in the past. Click the picture for extra element. On the flip aspect, it has NZ$1.95m in money resulting in internet debt of about NZ$17.7m.

A Look At Happy Valley Nutrition’s Liabilities

We can see from the latest stability sheet that Happy Valley Nutrition had liabilities of NZ$9.91m falling due inside a yr, and liabilities of NZ$9.99m due past that. Offsetting these obligations, it had money of NZ$1.95m in addition to receivables valued at NZ$17.4k due inside 12 months. So its liabilities complete NZ$17.9m greater than the mixture of its money and short-term receivables.

This deficit casts a shadow over the NZ$9.25m firm, like a colossus towering over mere mortals. So we positively suppose shareholders want to look at this one intently. After all, Happy Valley Nutrition would possible require a serious re-capitalisation if it needed to pay its collectors at present. When analysing debt ranges, the stability sheet is the plain place to begin. But it’s Happy Valley Nutrition’s earnings that may affect how the stability sheet holds up sooner or later. So when contemplating debt, it is positively value wanting on the earnings pattern. Click here for an interactive snapshot.

Given it has no important working income in the mean time, shareholders can be hoping Happy Valley Nutrition could make progress and achieve higher traction for the enterprise, earlier than it runs low on money.

Caveat Emptor

Importantly, Happy Valley Nutrition had an earnings earlier than curiosity and tax (EBIT) loss during the last yr. Its EBIT loss was a whopping NZ$2.8m. When we have a look at that alongside the numerous liabilities, we’re not notably assured in regards to the firm. We’d wish to see some sturdy near-term enhancements earlier than getting too within the inventory. Not least as a result of it burned by means of NZ$4.6m in destructive free money circulation during the last yr. So suffice it to say we take into account the inventory to be dangerous. There’s little doubt that we study most about debt from the stability sheet. But in the end, each firm can include dangers that exist exterior of the stability sheet. For instance, we have found 4 warning signs for Happy Valley Nutrition that try to be conscious of earlier than investing right here.

If you are serious about investing in companies that may develop earnings with out the burden of debt, then try this free list of growing businesses that have net cash on the balance sheet.

Have suggestions on this text? Concerned in regards to the content material? Get in touch with us instantly. Alternatively, e mail editorial-team (at) simplywallst.com.

This article by Simply Wall St is normal in nature. We present commentary primarily based on historic information and analyst forecasts solely utilizing an unbiased methodology and our articles usually are not meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We goal to carry you long-term targeted evaluation pushed by basic information. Note that our evaluation might not issue within the newest price-sensitive firm bulletins or qualitative materials. Simply Wall St has no place in any shares talked about.

Discounted money circulation calculation for each inventory

Simply Wall St does an in depth discounted money circulation calculation each 6 hours for each inventory available on the market, so if you wish to discover the intrinsic worth of any firm simply search here. It’s FREE.

https://simplywall.st/stocks/au/food-beverage-tobacco/asx-hvm/happy-valley-nutrition-shares/news/is-happy-valley-nutrition-asxhvm-using-debt-sensibly