Turnrounds are filled with surprises, Barry McCarthy remarked on Tuesday, because the veteran finance govt credited with pulling Netflix and Spotify by their robust early years held his first name with analysts since turning into Peloton’s chief govt.

Three months after the linked health firm employed him, the largest shock had been its money stream, he stated. For some on Wall Street, that was an understatement.

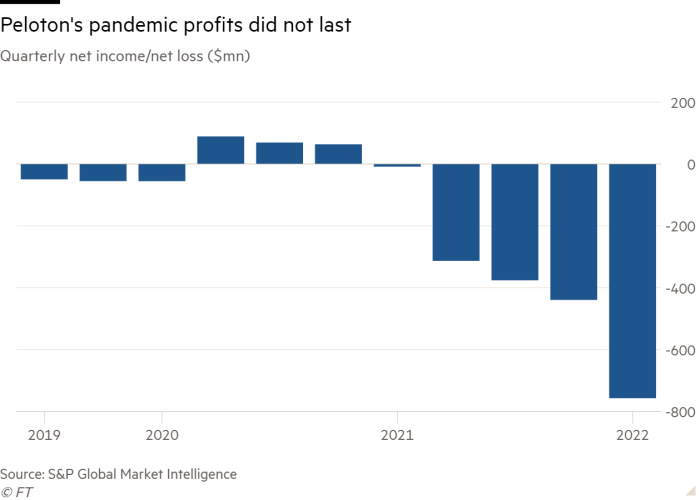

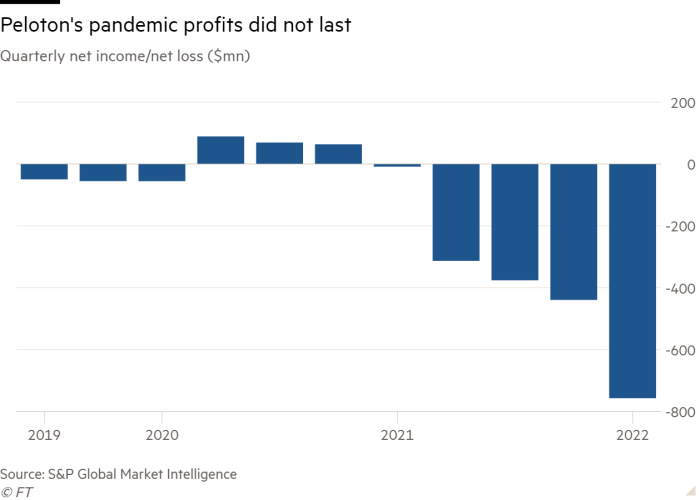

In the quarter to March 31, virtually $750mn of money flowed out of the corporate, up from about $200mn a yr earlier. The firm that had raised greater than $1.1bn at its preliminary public providing in September 2019 ended the interval with lower than $880mn in unrestricted money and money equivalents.

That, McCarthy admitted, left it “thinly capitalised” for its measurement. Peloton had organized to borrow one other $750mn, he stated, however the firm declined to reveal what rate of interest the banks have been charging.

The unwelcome money stream shock despatched Peloton’s shares to new lows, slicing its valuation to roughly half what it had been on the IPO and underneath one-tenth of the place it had peaked in 2020, when traders guess {that a} pandemic-era shift from gyms to dwelling health would outlast Covid-19.

The unravelling of these hopes within the face of strain from an activist investor, Blackwells Capital, has already led Peloton to maneuver co-founder John Foley out of the chief govt’s chair.

It has additionally deserted a deliberate $400mn manufacturing unit in Ohio and lower its workforce by 2,800 folks as a part of an effort to scale back prices by $800mn. And it has confronted hypothesis that it might be bought to a bigger group — regardless of McCarthy’s insistence that he didn’t be part of the corporate to promote it.

But Tuesday’s outcomes left analysts repeating questions that they had been asking earlier than Foley stepped again: is Peloton’s long-term imaginative and prescient of the dimensions of its potential market real looking, and is it even smart to be pursuing a mass-market technique when it constructed its model on the fanatical loyalty of a rich however far smaller group of shoppers?

Chief monetary officer Jill Woodworth reiterated the assumption that Foley had articulated on the peak of Wall Street’s optimism in regards to the firm: that half of the world’s present fitness center members — or 100mn folks — might someday be Peloton clients.

“It feels like new administration, identical story,” stated BMO Capital Markets analyst Simeon Siegel, a long-term sceptic: “The firm acknowledges they should flip themselves round and restructure whereas sustaining that their long-term alternative has not modified.”

With simply 7mn members on the finish of the most recent quarter, Woodworth conceded, “we’ve bought to evolve the technique pretty considerably to get to that 100mn”.

There are 4 “drivers” of that evolution, she stated: worldwide development, retail partnerships, increasing the attain of an app that requires no bike or treadmill, and rolling out a “fitness-as-a-service” programme that lets customers hire Peloton’s {hardware} and entry its courses for a month-to-month payment.

The name McCarthy and Woodworth held with analysts on Tuesday made clear, nevertheless, that there’s nonetheless vital uncertainty about every of these methods.

McCarthy stated he was “unsure but” in regards to the worldwide rollout, noting Peloton’s “finite” sources and the truth that geographic growth would price cash within the quick time period. “International has the potential to drive vital development however the extra development it drives early within the course of the extra money we lose,” he noticed.

It was too early to speak about potential partnerships with retailers, he added. Similarly, when requested what worth digital app subscriptions would add, he replied that he didn’t know.

The app “might be some premium type of mannequin. It might be a straight subscription mannequin. Not but positive,” he stated.

And whereas he hailed the early development in its fitness-as-a-service providing as encouraging Peloton’s perception that such subscriptions might usher in a “mass market” viewers of decrease earnings clients, he famous that it had thus far concerned simply 1,000 models.

He was “simply in love with the entire thing”, he stated of the fitness-as-a service idea, however he acknowledged that he was unsure whether or not it could ship the returns that Peloton hoped for.

McCarthy was extra definitive about what was nonetheless stopping the corporate from realising a few of its ambitions, nevertheless. The enterprise had “exploded” from about 700,000 subscribers to tens of millions for the reason that begin of the pandemic, he remarked, however its techniques nonetheless relied on “the unique code that was hacked when the enterprise was first organised”.

That was slowing down the velocity at which it might do issues like check different variations of its fitness-as-a-service providing, he stated. “I imply, actually? We have to attend till the top of June to have the ability to A/B check on the web site? That’s one thing that may take one and a half days at Netflix, even early on,” he recalled.

Some analysts, equivalent to Baird, are additionally seeking to Netflix and Spotify analogies, valuing Peloton in reference to McCarthy’s former corporations, however it has but to persuade others that it may possibly discover a related mass market of subscribers.

“The drawback is the corporate constructed the enterprise on the assumption that demand would by no means cease,” stated Siegel.

McCarthy maintains that he stays optimistic in regards to the path forward, “however the inventory value”. However, he has nonetheless to persuade holders of that inventory equivalent to Blackwells, which declined to touch upon Tuesday.

https://www.ft.com/content/d9804583-2c59-4451-9236-d240be313b25