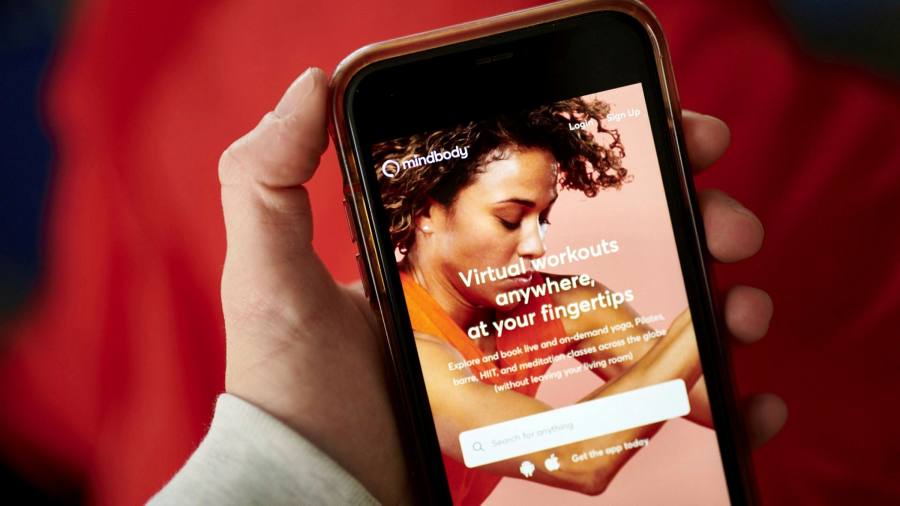

Mindbody, the health and wellbeing tech platform that owns train subscription service ClassPass, plans to go public as demand for in-person exercises grows following pandemic shutdowns.

A flotation would mark a return to the general public markets after simply 4 years away from the Nasdaq for California-based Mindbody, which was taken personal by Vista Equity Partners in 2019 in a deal that valued the corporate at $1.9bn.

The platform, which offers software program for gyms and spas enabling customers to e-book classes on-line, acquired ClassPass in an all-stock transaction final October. Investment agency Sixth Street additionally invested $500mn within the mixed firms on the time of the acquisition.

In an interview with the Financial Times, Mindbody chief government Josh McCarter stated an preliminary public providing would permit the corporate to pursue additional mergers and acquisitions to enhance its expertise, broaden internationally and transfer into different fields of wellness comparable to psychological well being.

“We have zero strain to go public for liquidity. We wish to have a public foreign money we are able to use for M&A”, McCarter stated, including that the itemizing would depend upon market volatility however that “2023 could be an excellent goal”.

“Our perception and our traders’ perception is that Mindbody is essentially the most logical consolidator out there to carry . . . wellness platforms collectively.”

ClassPass, which was valued at greater than $1bn in January 2020, affords customers a substitute for gymnasium membership by permitting them to e-book particular person studio courses and gymnasium classes at venues together with boutique operators 1Rebel and Barry’s by way of a subscription service.

Revenues fell 95 per cent in simply two weeks initially of the pandemic after ClassPass froze subscriptions. But chief government Fritz Lanman stated enterprise had rebounded strongly, with bookings up about 27 per cent in February 2022 in contrast with February 2021.

“[There is] demand for in-person experiences and that sense of group and teacher suggestions and accountability,” Lanman stated, including that members had been attending studios and courses 10 per cent greater than earlier than the pandemic.

Lanman doesn’t anticipate Covid-19 to weigh on attendance, including that as much as 98 per cent of ClassPass members are estimated to have been vaccinated. McCarter stated: “We suppose we’re in an endemic state, with no main shutdowns within the markets we function in,” which embody North America and Europe.

ClassPass has added extra spas and salons to its platform since coronavirus first took maintain. “People’s definition of wellness has expanded [since the pandemic],” McCarter stated. “Now it’s much more about stress discount and psychological well being [than physical fitness].”

McCarter dismissed the notion that ClassPass’s mannequin was “cannibalistic” by luring gym-goers away from conventional memberships, and stated small and medium-sized companies benefited from becoming a member of the platform. “Fifty per cent of ClassPass customers are new to the boutique business and 80 per cent are new to a selected enterprise,” he stated.

The proposed itemizing comes as related health companies comparable to Peloton lose momentum, with the train bike firm’s market worth falling from nearly $50bn initially of 2021 to lower than $8bn.

Simeon Siegel, an analyst at BMO Capital Markets, stated related health companies would proceed to kind a part of the health combine past the pandemic, however added, “the loss of life of the gyms has been significantly exaggerated”.

https://www.ft.com/content/4d3c0b63-05d4-4ed9-b186-92c4881d7c41