Congratulations, you’ve performed the arduous work! You began an funding plan, put it right into a tax-efficient Isa, and now your financial savings are firmly into 5 figures.

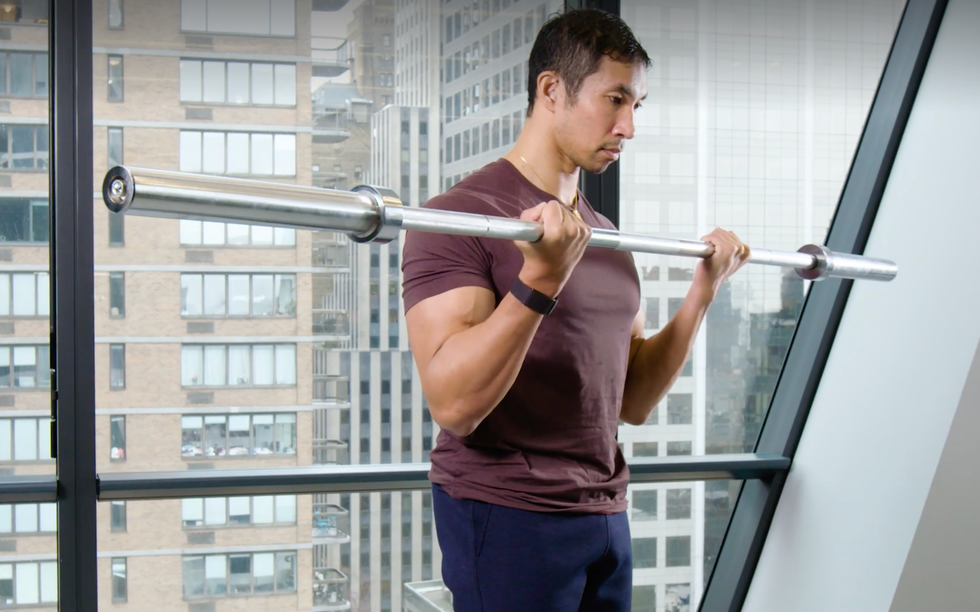

Your hard-earned cash is now not “sitting on the couch”. But how do you concentrate on constructing the funding as much as a financially match six figures?

First, be trustworthy with your self. Are you continue to a bit chubby in money? Some traders could have surplus funds incomes little or no in money, or a lump sum coming within the type of a bonus, so as to add to the funding plan. If you’re on this lucky group, you’ll have loads of money able to spend money on shares, bonds and funds.

Next, don’t run earlier than you possibly can stroll. Making common long-term investments often requires common long-term earnings. So keep in mind that securing and retaining a superb job is central to your monetary regime, significantly in these unsure occasions.

Third, totally settle for that the monetary equal of working in direction of a six pack isn’t one thing that may come shortly. Any funding that claims to make you wealthy in a matter of months is extremely speculative and will land you with the monetary equal of at the very least a muscle sprain and probably a severe harm.

It’s useful to look to the rising military of Isa millionaires for inspiration — 2,000 of them, in line with the most recent HM Revenue & Customs figures — and at how they’ve achieved their spectacular seven-figure sums over a number of many years.

But the typical age of 72 amongst Interactive Investor’s 983 Isa millionaires is a reminder that investing is a marathon, not a dash. All the investments you make at the moment ought to be “purchase and maintain”, stashed away for at the very least 5 years.

Any skilled athlete will let you know the important thing to crossing the end line forward of the pack is the constant habits they developed in apply. So, consider a short-term funding win as a pair of latest trainers — beautiful to have, and considerably useful in attaining long-term objectives, nevertheless it’s primarily the coaching which supplies the most effective returns.

Adding to your investments on a daily or month-to-month foundation is a great tool to propel you in your method. The strongest drivers are your funding selections and asset allocation — the way you diversify your cash to unfold the chance of all the things falling on the identical time.

With £10,000 of investments, you most likely have already got one or two collective funding funds within the pot.

Yes, a easy, low-cost multi-asset fund could possibly be your one-stop answer without end, however in apply, after you have greater than £10,000 to take a position, you’re prone to need to increase away from one or two funds. But do you have to add extra funds or purchase direct shares and begin taking increased dangers with a few of the cash?

Many traders choose to diversify between fund administration homes simply in case there’s a failure, similar to the collapse of supervisor Neil Woodford’s Equity Income Fund. Many folks mix a handful of collective investments with direct holdings in UK and worldwide shares. If you’re doing this, you’ll have to test for overlap, ensuring that the collective investments aren’t holding your chosen shares.

The portfolios of Interactive Investor’s Isa millionaires have been powered by funding trusts similar to Alliance Trust and Witan, that are all globally diversified portfolios of shares. Top shareholdings are dominated by FTSE 100 blue-chips, significantly oil, prescription drugs, banks and telecoms — holdings that might assist these traders within the race in opposition to inflation.

While it’s inspiring to take a look at how the very wealthiest have gotten there, the property which have performed effectively prior to now decade, similar to tech shares, gained’t essentially do effectively within the 2020s.

You’ll additionally want to consider your threat profile. Investment trusts, for instance, typically are likely to outperform funds in a rising market due the power to “gear” or borrow cash to take a position. But in a falling market, gearing may also improve losses. You may have to just accept a rockier journey over time of investing.

It’s potential to assemble a portfolio aiming for long-term development with round 10 collective investments, similar to funds and funding trusts. This ought to embody investments that target UK and worldwide shares, often the most important portion of a development portfolio, however have smaller quantities in funds or trusts that concentrate on bonds, industrial property, gold and personal fairness — main asset lessons that may unfold your threat.

Try to be good about the kind of collective funding that you just maintain.

For investments which might be much less liquid, which suggests they will’t be purchased or offered shortly, similar to industrial property, somewhat than a fund, it’s your decision an funding belief similar to BMO Commercial Property. Investment trusts discover it simpler to carry property which might be tougher to purchase and promote as a result of they don’t should cope with cash going into or out of their portfolios.

And for some forms of investments a low-cost tracker fund may be higher, for instance in bigger firm US equities. Investment guru Warren Buffett is keen on recommending an S&P500 tracker fund.

All the large funding platforms have suggestions of the best-in-class investments in numerous asset lessons, and tips on how to put them collectively in mannequin portfolios, which may help you along with your analysis.

But you’ll additionally have to do some ongoing upkeep of your investments.

Some health apps similar to Noom use psychology to get the burden off and deal with forming good habits. One of those is checking in in your weight on daily basis. But don’t really feel that you must test your portfolio on daily basis. Good investing may be performed even in the event you’re brief on time.

Do schedule a overview at the very least a few times a yr. This is your alternative for a little bit of rebalancing if the portfolio seems to be skewed to 1 asset class.

If you may have the time, perhaps test in as soon as a month on the way it’s performing. But checking too typically may be counterproductive — it could simply make you are worried concerning the ups and downs of the markets.

Your emotional response to an increase or fall in worth could drive you to purchase or promote an funding when it could be higher to stay to the plan and maintain on for the long run. So, like all steps to health, reaching your objective will take some psychological toughness.

Moira O’Neill is head of non-public finance at Interactive Investor

https://www.ft.com/content/af568cd2-4577-40ee-b108-dae073432c62